We love to travel and save money while doing so. That’s why we’re always looking for ways to travel cheaper.

For hotels, flights, and car rentals, we almost always use the Avion Rewards program. We didn’t search for or choose this program; it came with our RBC bank account, but we liked it and have continued to use it actively. The idea behind this program is that for every dollar spent, you earn one point. These points can be spent on anything: travel, shopping, and bill payments. So, it’s like a hidden cashback.

When making purchases, every 100 points equals one dollar. You can order anything with them. Another advantage is that in the Avion Rewards program, hotels, cars, and flights are sometimes cheaper than if you search for them independently on websites. For example, we just booked a car for our trip around Europe – on all the websites it was around $800 per week, but through the rewards, it was $450. So, the benefit is twofold.

How it works: As I mentioned, our Avion Rewards program is linked to our bank account. But this is not necessary. If you don’t have an account with this bank, you can create an account directly on the Avion Rewards website. This program is Canadian (there is a similar program for the US called Avion Rewards US), which means to participate in the Avion Rewards Program, you need to have an account with any Canadian bank.

We log into the system.

We choose “Travel” if we want to travel.

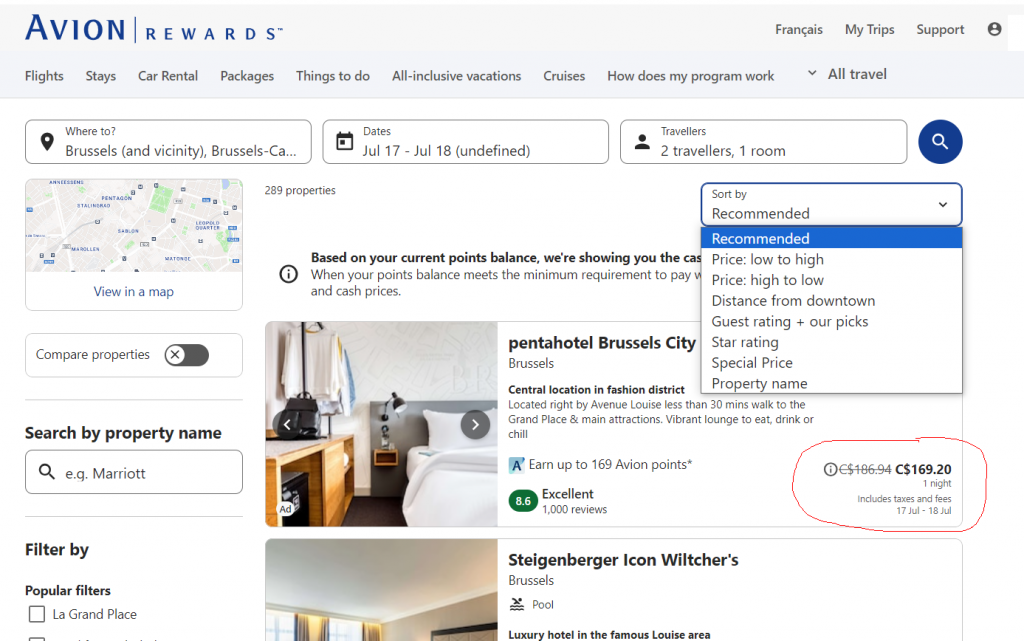

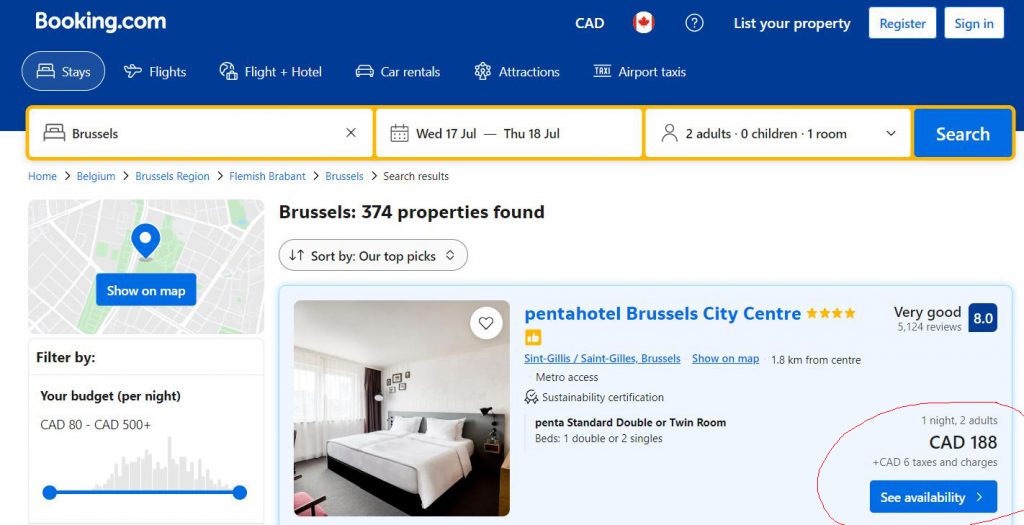

Let’s say we want a hotel in Brussels for one night in July. We enter all the details and get the results. The list can be sorted by price, rating, distance from the city center, and so on. Each hotel has reviews, descriptions, and booking options. We choose one and make a reservation.

If we look at the price of the same hotel on booking.com for the same dates, we will see that the room on booking.com is $19 more expensive, plus an additional six dollars for taxes. The savings are clear.

Pros and Cons of the RBC Avion Rewards Program

Pros:

- Earning Points: Avion offers a decent points-earning rate. You typically get 1 point per dollar spent on everyday purchases, with bonus points on travel and other categories depending on your credit card. For example, the RBC Avion Visa Infinite card bumps that rate up to 1.25 points per dollar.

- Flexibility: Avion points can be redeemed for flights on a wide range of airlines, including major carriers like Air Canada and international options through partner programs. You can also use your points for hotels, car rentals, and even statement credits.

- Travel Perks: Some Avion cards come with handy travel perks like airport lounge access, travel insurance, and priority boarding. These can make your trips smoother and more enjoyable.

Cons:

- Limited Transfer Partners: Compared to some other programs, Avion’s transfer partners for airlines and hotels might be a bit limited. This could restrict your redemption options.

For us personally, this is not a significant drawback because we use the points only for hotels, cars, and flights, and everything we need is on this list. - Annual Fees: Some of the cards with the best earning rates and travel perks come with annual fees. You’ll need to weigh the benefits against the cost to see if it makes sense for you. We do not pay annual fees, but I think this depends on your bank account. Our account allows us to have premium Avion Rewards without an annual fee.

- Foreign Transaction Fees: Be aware that some Avion cards charge foreign transaction fees, which can eat into your travel savings if you’re using your card abroad. We haven’t encountered this issue because we use the points only for booking hotels, but it’s important to be aware of it regardless.

Overall, Avion seems like a solid rewards program for Canadians who travel regularly, especially within North America. Earning points on everyday purchases and having the flexibility to redeem them for flights on various airlines is a definite plus. However, it’s important to consider the potential downsides, like limited transfer partners and annual fees, to see if it aligns with your travel style and budget.